You may take advantage of some mortgage refinancing tax deductions, such as those for interest and discount points, to lower your federal income taxes by filing an itemized tax return.

The majority of homeowners refinance their mortgages to qualify for a cheaper interest rate, change their payment terms, or access their home equity.

However, there are various mortgage refinancing tax breaks available to you.

These deductions, which you may claim after refinancing your mortgage, help to reduce the amount of federal income taxes you owe – and you shouldn’t pass them up.

What Is a Mortgage Refinance Tax Deduction?

A deduction is a cost that reduces your tax liability. When you take a deduction, you lower the amount of money on which you must pay taxes.

For example, if you make $100,000 before taxes and had $10,000 in deductions, you would only pay taxes on $90,000 of your earnings.

Refinance tax deductions are specific deductions that you may claim after refinancing your home loan.

Is Refinancing Tax Deductible?

Unfortunately, there is no simple solution and you will not receive emergency cash immediately in this case.

Refinancing may or may not have an impact on your taxes, depending on the kind of refinancing and how you file.

In general, your mortgage affects your taxes only if you itemize your deductions.

And, if you utilize a standard rate-and-term refinancing, there aren’t going to be any tax consequences. Cash-out refinancing may have some, but you will not be taxed on the equity you sold out.

What Refinancing Tax Deductions Are Available?

The most typical tax deductions for refinancing revolve around the interest you’ll pay on your new loan and any expenses you spend to decrease the interest rate on your new loan.

Mortgage Interest Deduction

The mortgage interest deduction on both your initial loan and refinancing is generally the largest deduction you’ll be able to claim.

Deducting interest on a cash-out refinancing, on the other hand, is subject to unique regulations.

Standard Rate And Term Refinance Mortgage Interest

If all of the following requirements are met, you may deduct any interest paid on your refinanced loan:

The financing is intended for your main dwelling or a secondary home that you do not rent out.

You may rent out a second house and still claim the deduction if you remain in it for more than 14 days or more than 10% of the days the property would normally be available for rent, whichever is longer.

Your house is encumbered by a lien from the lender that financed it. This implies that if you fall behind on your payments, your lender has the authority to take your property or foreclose on your loan.

Deduction for Cash-Out Refinance Interest

In cash-out refinancing, you refinance for more than your current mortgage loan balance.

You then take the additional money and pay it back each month when you make your normal mortgage payments.

If you use the money to pay for renovations that boost the value of your house, you may deduct the whole amount of interest paid on a cash-out refinancing, up to a ceiling of $750,000.

If you use the money for anything else, such as paying off credit card debt or financing a child’s college tuition, you may only deduct the interest you pay on the initial sum of the loan.

Discount point deduction

Some individuals pay more at closing to get a lower mortgage rate. If you do this, you are purchasing “discount points.”

And you may deduct the whole cost of them at the end of the tax year in which you purchased them.

However, those points must now be deducted “pro rata” (in equal increments) during the life of your loan.

If you have a 30-year loan, you will deduct one-third of the amount each year. A 15-year loan allows you to deduct one-fifteenth of the amount each year.

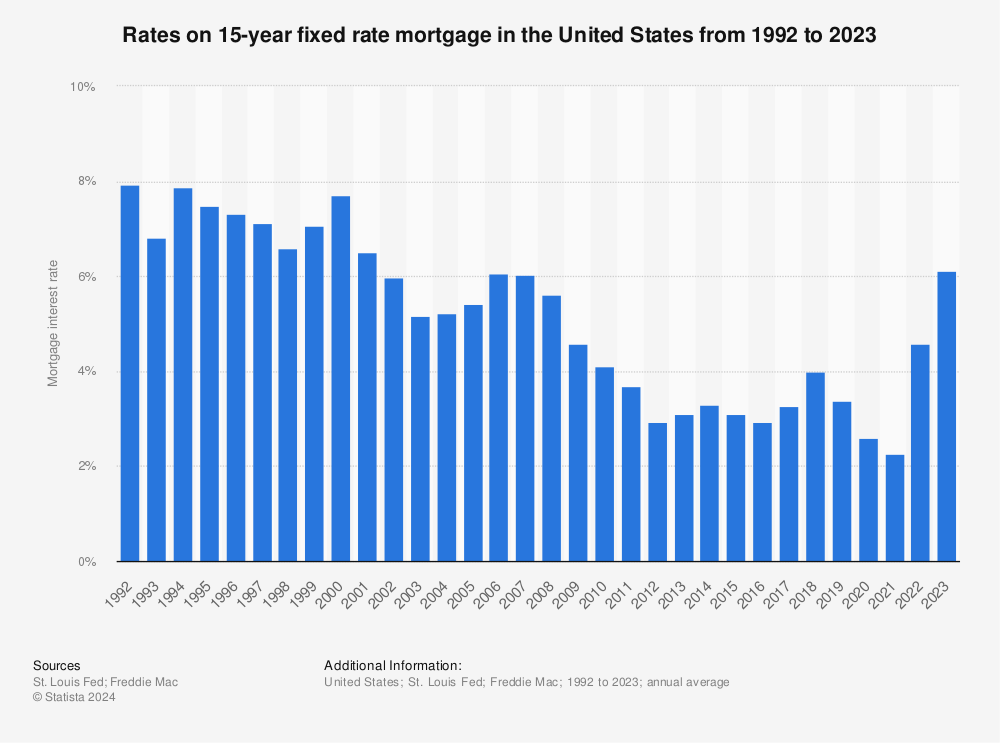

This can help a lot nowadays because the interest rate has risen in the last year, as the statistics tell us.

15-year fixed rate mortgages had rates between six and nine percent during the beginning of the 1990s. By the end of 2021, the rate had dropped to a historic low of 2.33 percent.

Mortgage rates rose in 2022 as a consequence of the Federal Reserve raising the bank rate, a strategy implemented to combat the possibility of growing inflation.

Rates on 15-year fixed rate mortgage in the United States from 1992 to March 2022

Find more statistics at Statista

Link: https://www.statista.com/statistics/187656/rates-on-conventional-15-year-fixed-mortgages-in-the-us/

It’s also worth noting that if you folded the cost of discount points into your loan debt rather than paying them upfront, you can’t deduct them individually.

Deductions for Rental Property Closing Costs

The majority of rental property closing expenses are tax-deductible on Schedule E and do not need the filing of an itemized return.

Some expenditures, however, cannot be subtracted when refinancing your rental property. Mortgage points are an example of this when the loan amount is more than the initial sum.

For example, if you had a cash-out refinancing on an investment property that increased in value, any amount of the points that exceeded the initial loan total cannot be deducted as a rental expenditure.

Will Refinancing Increase My Property Taxes?

No, even if you obtain a fresh, higher assessment when you refinance, refinancing will not have a direct effect on your property taxes.

This is because your local tax authority assesses your property taxes based on its appraisal of your home’s worth. Your mortgage appraiser’s appraisal will have no bearing on this.

However, if the lender’s assessment reveals that your house is worth much more than your tax authority believes, this might indicate that you live in an area with quickly growing property values.

As a result, your property taxes may rise next year. However, this is entirely due to property price inflation.

Conclusion

Refinancing a mortgage may result in a reduced monthly payment or tens of thousands of dollars in interest savings over the life of the loan.

Refinancing may also result in tax breaks, especially on the amount of interest paid on your new mortgage loan each year.